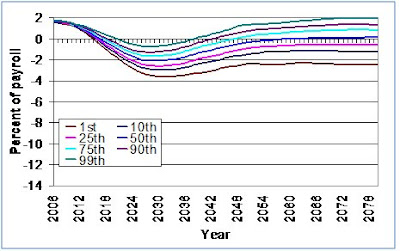

I have a new working paper that examines auto-correction policies for Social Security taxes and benefits that would help adjust for uncertainty regard future demographics. (I talk a bit about adjusting for economic uncertainty, but will do some more detailed work on that in the future.) Here's the basic story, in pictures. Figure 2 shows the probability distribution of Social Security's net cash flow (income minus outgo), programmed to match the stochastic simulations contained in the Social Security Trustees Report. The median outcome matches the Trustees intermediate projections, but there's obviously a ton of variability. There's about a 1 percent chance we'd be almost in positive cash flow in 2080, but an equal 1 percent chance of cash deficits of 12 percent of payroll. What can policy do about this? Figure 2: Stochastic simulation of Social Security cash flows, SSASIM model One policy option is to index initial benefits to price growth rather than wage growth. This will definitely improve expected outcomes for solvency – based on the intermediate projections, this chance alone would fix financing in perpetuity. However, price indexing also increases uncertainty regarding system financing, because benefits no longer adjust to changes in wages (higher wage growth equals higher benefits, lower wage growth equals lower benefits). Figure 4 below illustrates: the median outcome is a lot better than current law, but the level of uncertainty is actually higher. Figure 4: Stochastic simulation of cash flows under price indexing, SSASIM model So here's an alternate idea: index changes in taxes and benefits to changes in the ratio of workers to beneficiaries. Long-run, demographics are the biggest sources of variation in system financing (because most of the economic uncertainty gets handled through wage indexing of benefits). The worker-beneficiary ratio accounts for both changes in fertility (workers) and mortality (beneficiaries). If we index to that, we'll account for much of the uncertainty in the long run. Figure 6 illustrates indexing of benefits to the worker-beneficiary ratio, although the paper also contains a similar chart showing tax indexing. I set things up so that the average affect of the change on solvency would equal that of price indexing – that is, sustainable solvency based on cash flows. However, the level of uncertainty is far smaller. Figure 6: Stochastic simulation of cash flows under dependency indexing of benefits, SSASIM model This approach has several advantages. First, it helps deal with the folks who claim the Trustees are pessimistic and there's no real problem lurking in the future. If so, there's no danger in implementing auto-correction policies, since they only make changes as needed. This might help get reform enacted sooner, which is important. Second, auto-correction policies keep financing on a stable basis, which helps smooth burdens more reliably between generations. Without auto-correction, policymakers are likely to wait until the last minute to make changes, which inevitably pushes larger burdens off onto later generations. Third, auto-correction policies give future generations the chance to change Social Security as they wish, from a baseline of solvency rather than insolvency. There are some other issues to address, such as indexing for economic uncertainty, how to deal with uncertainty regarding how future outcomes are modeled – e.g., the large change in Social Security solvency that occurred in the 2008 Trustees Report was principally due to changes in how immigration was modeled, not to assumptions regarding immigration levels. But as a general class of reforms, I think auto-correction policies have an important role to play. Plus, Obama policy guru Jason Furman also likes them, which means we may see them sometime in the future.

Thursday, July 3, 2008

New paper: Policies to reduce uncertainty in Social Security financing

Subscribe to:

Post Comments (Atom)

3 comments:

At the risk of blowing my own horn I suggested a similar model a couple of years ago in a MyDD diary Goldilocks and the Three Social Security Bears and more recently at AB XXVI: Social Security Low Cost & the 100/100 Target. Now my model differs somewhat because it targets an outcome primarily from the perspective of the beneficiary (100% of scheduled benefit) whereas the Biggs plan targets an outcome from the perspective of the taxpayer (sustainable solvency without tax rate increases) but there is no reason we cannot reach both destinations while travelling down the same practical road.

I don't know if it was the release of the Technical Panel's Report on Assumptions and Methods that caused this looming consensus on moving from a totalizing model (it's broken, lets start from scratch) to an adaptive model (monitor, maintain, and adjust as needed) or whether it just marked something that was going on all along. Either way it is a welcome development.

Which is not to say that I totally buy into the privileging of demography over productivity argument, but the beauty of the Biggs approach is that ultimately it doesn't matter: the results are the results whether we measure that in terms of dependency ratio, Trust Fund ratio or percentage of GDP.

Plus if I can be foregiven going into full out crass self-congratuatory mode, any solution that maintains the basic framework of Social Security as it was devised during the New Deal is an ideological victory for New Deal and (dare I say it) Social Democratic principles. My pal Coberly may see this as selling out our committment to delivering 100% of benefits, but from my standpoint all it requires is betting on America and America's ability to deliver an economic future as bright or brighter than America's economic past. In these days of Roubini-esque gloom that may be seen as too optimistic for words, but heck if you can't bet on the United States on the Fourth of July what's the point of being a proud American?

I don't wish "sell out" my pal Bruce, but demogrphics is primary (not priveliged) in understanding and addressing long term solvency of Social Security. It holds that prime position because of its uncertainty. In the short term (such as the last ten years) it is not prime because over that time frame it is relatively certain. (All of the workers 10 years from now have already been born.)

The improvement in SS over the past ten years can be seen as the ratio of workers to beneficiaries being driven higher as the economy performed extremely well.

I would like to see in the paper:

Each of the Monte Carlo trials should produce a history of benefit or tax changes. Taken as a group that would provide a stochastic projection of the changes. A chart of benefit reductions (with 10 and 90 percent values, etc) for indexed benefits and a chart of tax increases for indexed payroll taxes would add to the paper. Benefits could also be shown as a percentage of benefits per current policy and percentage of current benefits (indexed by CPI).

I would expect the charts to back up coberly's estimate of the (quite reasonable) tax increase needed to maintain benefits.

I would also like to see a treatment of the trust fund.

Comparing Figure 1 and Figure 3 in my head, it would appear that the TF would be increasing in 2054 without ever being reduced below 100. If you include interest on a TF which is never allowed to drop below 100, then you can tolerate a net cash flow of about -1 percent of payroll indefinitely. So, bot only can the TF allow the worker of 2055 to get more than $15587, it can extend the transition time to reduced benefits.

Post a Comment