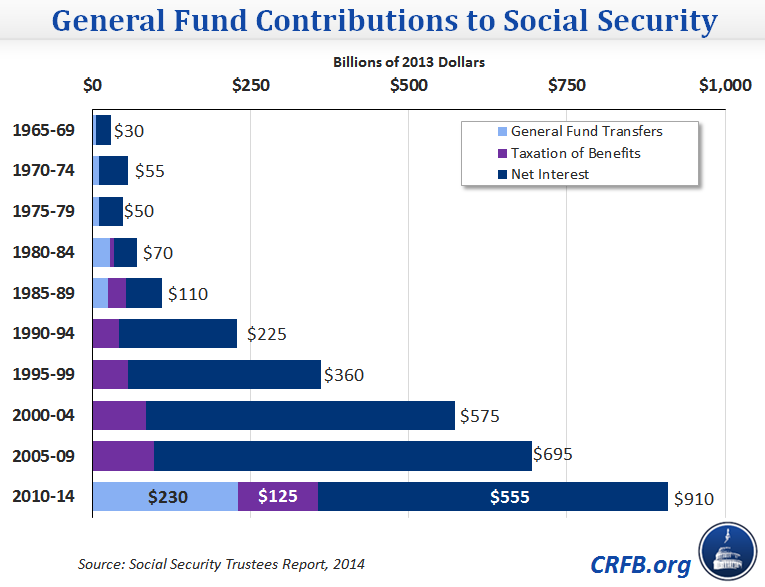

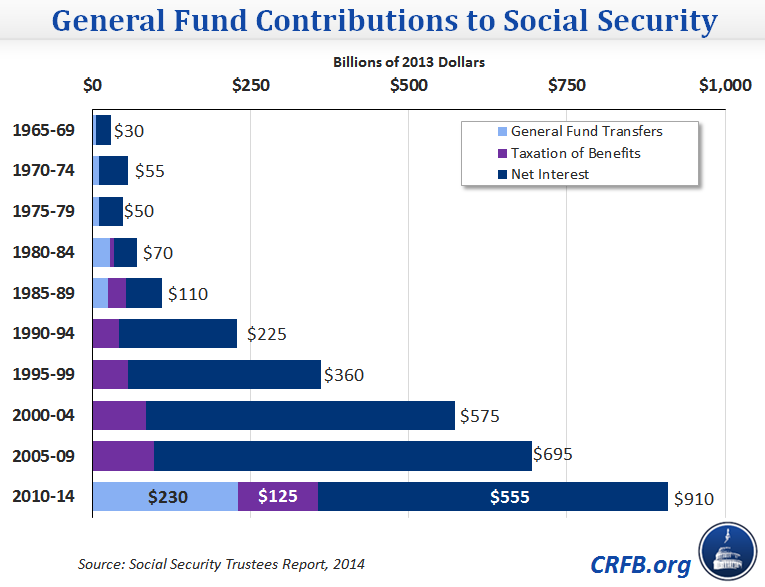

The Committee for a Responsible Federal Budget has published a nice review of how Social Security interacts with the rest of the federal budget – a subject that generates confusion even at the highest levels of government.

Occasional comments on the economics and politics of Social Security policy by Andrew Biggs.

The Committee for a Responsible Federal Budget has published a nice review of how Social Security interacts with the rest of the federal budget – a subject that generates confusion even at the highest levels of government.

3 comments:

"<>As Paul Van de Water at CBPP has explained, "when Social Security needs to start cashing in its holdings of Treasury securities to meet its benefit obligations, the federal government [the general fund] will have to increase its borrowing from the public, or raise taxes or spend less" to finance these costs."

This same event happened between 1957 and 1965, 1971 - 1983. Why is redeeming US Treasuries a problem? It is only a problem if they can refinance the debt. No different than refinancing a mortgage; one entity is paid off while another entity owns a note.

As for interest or taxes paid by government workers covered by SS since 1983, this is not a transfer of general revenues.

The only direct transfers were tax credits and the service personnel credits.

Teh write has no idea as to the magnitude of the problem. It takes an individual decades to save for retirement. What we have as a nation are some 42 million drawing benefits while 160 million are working and $2.7 Trillion in the bank. When you look at the weighted average of our Country to save for retirement ie. Social Security, we have less then six years left. Could any person start saving at age 61 and hope to save enough to retire by age 67? Pretty remote chance!!!

"When you look at the weighted average ... we have less then six years left"

SS is PAYGO. If you analyze it as if it were not, it is going to fail to meet your expectations.

If you think that we are better off if our aunts and uncles live shorter lives, then SS will fail by your standards.

Arne, I have no idea what your math background is. Paygo is what Social Security has turned into, not what it was meant to be. The problem began in the depression and continued during the 40's and 50's and no one did a thing about it.

Arne thinks that the payroll tax of 1950 3% on the first $4,500 was ok. It would appear that Arne thinks the payroll tax of 10.6% on the first $118K is also ok and is not a problem.

Arne appears to think that paying 18% payroll tax on the first 240% of the average wage will be ok in the future. Keep in mind that this is based on paygo and that everyone will just bend over and accept it forever.

Something has to give; either SS benefits are cut or SS taxes are raised. Every time SS taxes went up we see reduced savings and reduced wealth creation. Arne, I cannot teach you math or how to save at your age. Good luck.

Post a Comment